There are calls for the income tax agreement between Geneva and France to be renegotiated as some on the French side feel they’re not getting their fair share of the revenue generated by their residents.

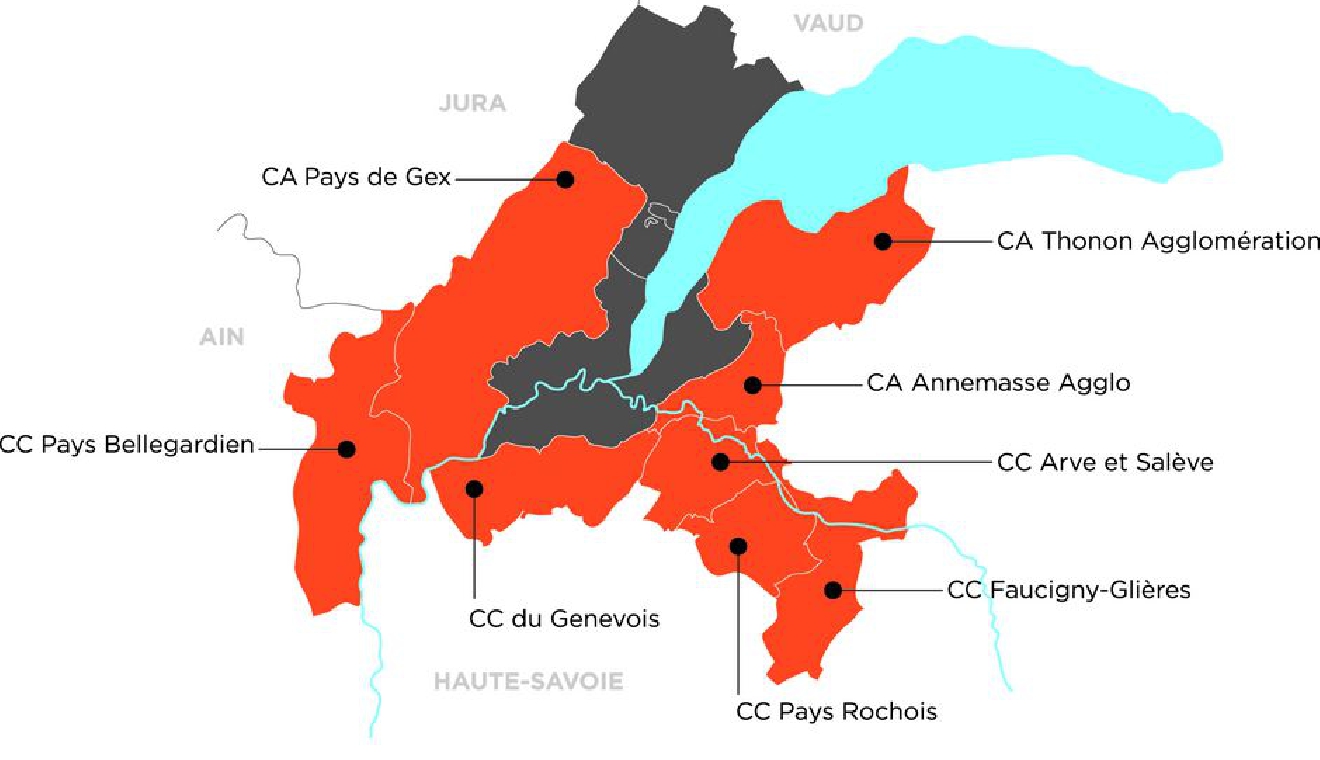

Under an agreement that goes back to the seventies, Geneva collects income tax on workers in the canton who live in France and then pass on 3.5% to France which is distributed to the bordering communes.

As the number of frontaliers increase, that amount is also climbing - more than CHF 15m in the last two years.

But border workers groups believe that’s not enough to make sure the neighbouring French region can maintain its infrastructure to allow for transport and others areas of social cohesion.

Michel Charrat from the European Cross Border Group says the deal needs to be discussed.

But any talks will have to be between Bern and Paris – and not with local communities.

Thousands of Swiss nationals stuck in middle east

Thousands of Swiss nationals stuck in middle east

Anti-war demonstrators in Geneva

Anti-war demonstrators in Geneva

Parmelin signs EU deal

Parmelin signs EU deal

Parliament moves closer to end murder loophole

Parliament moves closer to end murder loophole

Water worker buried alive

Water worker buried alive

Petition for quiet cars on trains

Petition for quiet cars on trains